Understanding the Affordable Care Act

Kessler Alair Insurance Services

The Patient Protection and Affordable Care Act (ACA) was signed into law on March 23, 2010. The law has had various segments of implementation based on a required timeline. The law has been amended several time since the bill was first passed.

Beginning in 2015, employers with 50+ full-time employees or full-time equivalents must offer medical coverage that is “affordable” and provides minimum value to full-time employees and their children up to age 26 or face penalties.

What is “affordable”?

Coverage is “affordable” if employee only contributions are less than 9.5% of:

- Employee's W-2 wages

- Employee’s monthly wages (hourly rate x 130 hours per month), OR

- Federal Poverty Level for a single individual

A plan must pay 60% of the cost of covered health services to provide "minimum value."

Essential Health Benefits that cannot have annual or lifetime dollar limits.

Although states are given some flexibility, the essential health benefits package must include items and services from the following ten categories:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance abuse disorder services including behavioral health treatment

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Lab services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care.

Many essential benefits vary state to state: i.e. acupuncture, autism, wigs, TMJ, infertility, bariatric surgery, chiropractic care, hearing aids. For large group you will need to decide the contract/situs state.

Who Must Cover EHB?

Cost Sharing LimitsWhat are they?

As of 1/1/2014, or your plan year anniversary In-network out-of-pocket (OOP) maximums in non-Grandfathered plans cannot exceed $6,350 for Individual, or $12,700 for Family.

Out of Pocket include all: Co-pays, deductibles, and co-insurance.

Beginning in 2015, the OOP family maximum cannot be more than twice the individual maximum

Health Exchanges Federal & State

The federal exchange website is www.healthcare.gov. In California it is www.coveredca.com.

There are 17 states that have their own exchanges. The link below directs you to the page were you can select a state at the bottom of the webpage and determine if the particular state has their own exchange or are in the federal exchange. healthcare.gov/what-is-the-health-insurance-marketplace

Exchanges will offer individuals a choice of health plans that meet certain benefit and cost standards. The Department of Health and Human Services (HHS) administers the requirements for the Exchanges and the health plans they offer.

Health Insurance Premium Tax Credit -Starting in 2014, individuals and families can take a new premium tax credit to help them afford health insurance coverage purchased through an Affordable Insurance Exchange. Exchanges will operate in every state and the District of Columbia. The premium tax credit is refundable so taxpayers who have little or no income tax liability can still benefit. The credit also can be paid in advance to a taxpayer’s insurance company to help cover the cost of premiums.

Some consumers are not eligible for premium assistance if they have access to other government (e.g., Medi-Cal or Medicare) or employer sponsored “Minimum Essential Coverage” (MEC) that is affordable and offers minimum value.

- Employer sponsored coverage affordability: Is considered affordable if the employee’s share of the annual premium for self-only coverage is no greater than 9.5% of annual household income.

- Minimum Value: Job-based coverage provides minimum value if it pays for 60% of the benefits covered by the plan. Individuals must pay no more than 40%.

- Affordability: A plan is considered affordable if the person is required to contribute 8% of their income or less towards the plan. An individual will not be required to pay the penalty for not having insurance if the health insurance premiums in the plans offered exceed 8% of their family/household income.

Individual Mandate

Under health care reform law, all people must have minimum essential coverage beginning January 1, 2014

People have "minimum essential coverage" if they have a Government-sponsored plan, Employer-sponsored plan or Individual plan

People can choose to buy health insurance on or off state insurance exchanges that will be open to write business effective Jan 1, 2014. Some people can also get federal premium assistance on an exchange.

If a person cannot keep minimum essential coverage, the Internal Revenue Service will collect a tax penalty from him or her. The monthly tax penalty is described as 1/12th of the greater of:

For 2014: Greater of $95 per uninsured adult and $47.50 per child in the household (capped at $285 per household) or one percent of the household income over the filing threshold

For 2015: Greater of $325 per uninsured adult and $162.50 per child in the household (capped at $975 per household) or two percent of the household income over the filing threshold

For 2016: Greater of $695 per uninsured adult and $347.50 per child in the household (capped at $2,085 per household) or 2.5 percent of the household income over the filing threshold

The penalty is half of the amount for people under age 18.

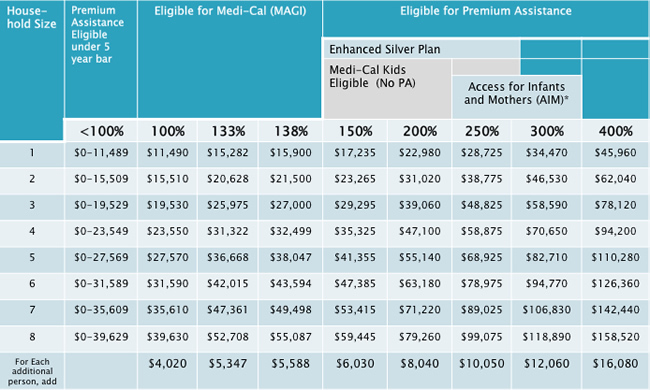

Program Eligibility by Federal Poverty Level

Subsidy Calculator

You can find an interactive Subsidy Calculator tool that determines if a person would be eligible for a subsidy in the exchange/marketplace at kff.org/interactive/subsidy-calculator

Penalty Exceptions

There are a few exceptions to the penalty, including:

- Religious reasons

- Not present in the United States

- In prison

- Not able to pay for coverage that is more than eight percent of the household income

- An income that is below 100 percent of the poverty Level

- Having a hardship waiver

- Not covered for less than three months during the year

What is the fee for not having health insurance in 2016?

The fee is calculated 2 different ways – as a percentage of your household income, and per person. You’ll pay whichever is higher.

Percentage of income:

- 2.5% of household income

- Maximum: Total yearly premium for the national average price of a Bronze plan sold through the Marketplace.

Per person

- $695 per adult

- $347.50 per child under 18

- Maximum: $2,085

Paying the fee

- Using the percentage method, only the part of your household income that’s above the yearly tax filing threshold ($10,150 for individuals, $20,300 for couples filing jointly in 2014, the most recent year available) is counted.

- Using the per-person method, you pay only for people in your household who don’t have insurance coverage.

- If you have coverage for part of the year, the fee is 1/12 of the annual amount for each month you (or your tax dependents) don’t have coverage. If you’re uncovered only 1 or 2 months, you don’t have to pay the fee at all.

- You pay the fee when you file your federal tax return for the year you don’t have coverage.

There are a few exemptions to avoiding the tax penalty, but the employee would have to answer specific questions about their household to determine if they would be exempt from the fee. https://www.healthcare.gov/exemptions-tool/#/ .

Medicaid and CHIP coverage is considered qualified health care. Here is the link to see if the employee or their dependents may be able to qualify for Medicaid or CHIP. https://www.healthcare.gov/medicaid-chip/getting-medicaid-chip/

The information was obtained from https://www.healthcare.gov/fees/fee-for-not-being-covered/